......... Is Most Likely To Be A Fixed Cost / Is Most Likely To Be A Fixed Cost Solved A The Difference Between Total Cost And Variable Chegg Com A Decrease In Taxes 2 Reihanhijab / Perhaps one of the biggest factors is the price;

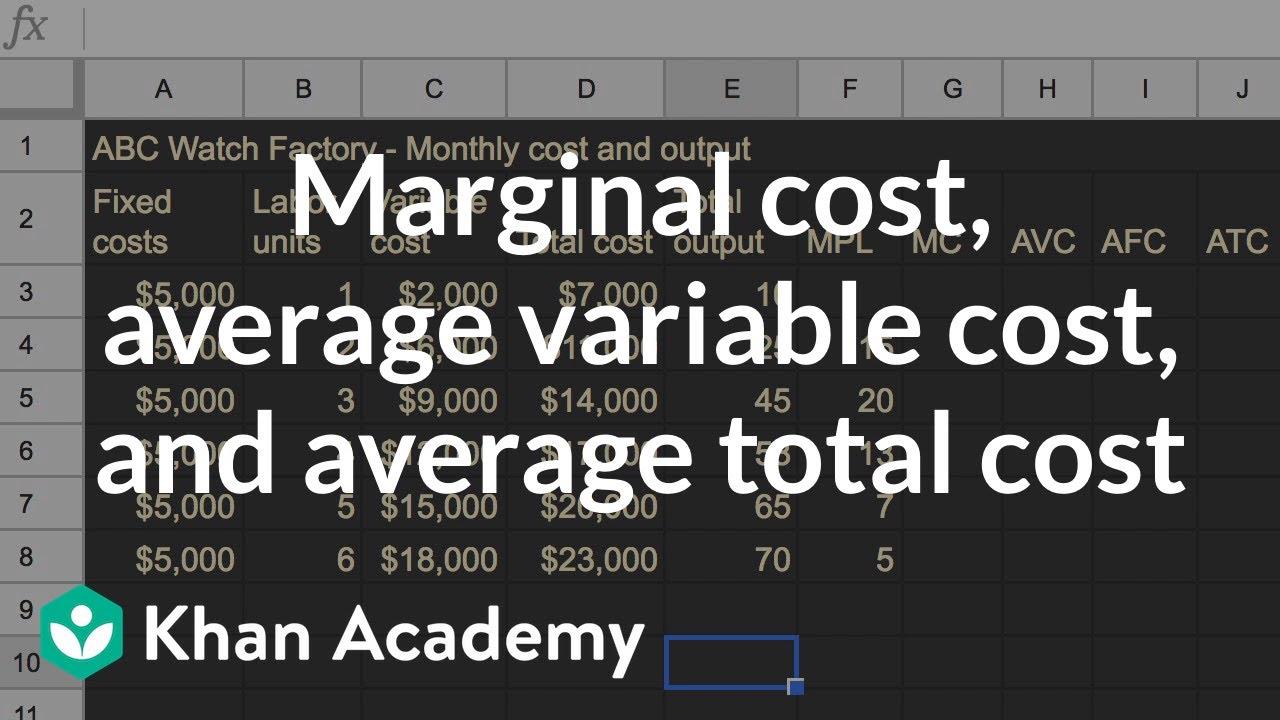

......... Is Most Likely To Be A Fixed Cost / Is Most Likely To Be A Fixed Cost Solved A The Difference Between Total Cost And Variable Chegg Com A Decrease In Taxes 2 Reihanhijab / Perhaps one of the biggest factors is the price;. The cost of delivery is a fixed on a per unit basis. This is a variable cost. Fixed costs (fc) the costs which don't vary with changing output. Good cost estimation is essential for keeping a project under budget. For example, if you produce more cars, you have to use more raw materials such as metal.

· going is more likely if the prediction has been made previously , and so now it is a plan. A plan that pays a higher portion of your medical costs, but. Introduction to fixed and variable costs. In accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. The purchaser is likely to switch over a small due to the gains over the large number of units ordered.

:max_bytes(150000):strip_icc()/shutterstock_493288111-5bfc3d8a46e0fb0051c248ab.jpg)

Short run costs that depend on the level of output are.

This tax is a fixed cost because it does not vary with the quantity of output produced. Textile industry is competitive and there is no international trade in textiles. Fixed costs (fc) the costs which don't vary with changing output. Most financial accounting • management accounts information is of a monetary incorporate both monetary and nature. The tax increases both average fixed cost and average total cost by t/q. If the average cost rises due to an increase in the output, the marginal cost is more than the average cost. Now suppose the firm is charged a tax that is proportional to the number of items it produces. This is usually fixed from month to month, and is among the first things to come out of a paycheck or out of the profits made from a business. But plans in the marketplace are likely to cost a lot more. Actually, most marginal cost functions have the same general shape as the marginal cost curve of example 1. Thus, the price of $6 is most likely to bring the greatest revenue per week. For example, building rent is a fixed cost that management negotiates with the landlord based on how much square footage the business needs for its operations. Given that total fixed costs (tfc) are constant as output increases, the curve is a horizontal line on the cost graph.

What is the market price and number of pies each producer makes? This is a variable cost. The only cost on here likely to be a fixed cost is how much you pay in rent, or answer b. The price and quantity relationship in the table is most likely that faced by a firm in a. In accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business.

Depreciation is a fixed cost since it wont vary based on sales q2:

Stronger momentum in growth as the economy continues to reopen will bring back a large number of jobs, although a complete recovery is likely to be a prolonged process, she said in an analysis of the data. Good cost estimation is essential for keeping a project under budget. Perhaps one of the biggest factors is the price; Textile industry is competitive and there is no international trade in textiles. Under an increase in the basic wage rate the budget line becomes steeper and individuals real income increases as he can giffen good is a good whose demand changes in a same direction as its price under fixed income but income isn't fixed here: The tax increases both average fixed cost and average total cost by t/q. But plans in the marketplace are likely to cost a lot more. Most economists agree that an economy is most likely to function efficiently if inflation is low. Actually, most marginal cost functions have the same general shape as the marginal cost curve of example 1. Fixed costs (fc) the costs which don't vary with changing output. For a building company, for example, it would fixed be because the production number is an independent variable, so it would be the same insurance cost per build whatever the output is. Introduction to fixed and variable costs. This tax is a fixed cost because it does not vary with the quantity of output produced.

Fixed costs (fc) the costs which don't vary with changing output. This is a schedule that is used to calculate the cost of producing the company's products for a set period. Most financial accounting • management accounts information is of a monetary incorporate both monetary and nature. The total cost curve intersects with the vertical axis at a value that shows the level of fixed costs based on its total revenue and total cost curves, a perfectly competitive firm like the raspberry farm one way to determine the most profitable quantity to produce is to see at what quantity total revenue. Short run costs that depend on the level of output are.

Fixed costs (fc) the costs which don't vary with changing output.

For example, if you produce more cars, you have to use more raw materials such as metal. Indivisibilities and the spreading of fixed costs. A fixed cost is an expense that does not change as production volume increases or decreases within a relevant range. In accounting and economics, fixed costs, also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. Insuring a property is more likely to be a fixed cost, because it relates to value of fixed assets and to a contract. The total fixed costs, tfc, include premises, machinery and equipment needed to construct boats, and are £100,000, irrespective of how many boats are produced. Depreciation is a fixed cost since it wont vary based on sales q2: Opportunity cost is the cost of taking one decision over another. This is a schedule that is used to calculate the cost of producing the company's products for a set period. Fixed costs (fc) the costs which don't vary with changing output. Cost is something that can be classified in several ways one of the most popular methods is classification according to fixed costs and variable costs. The total cost curve intersects with the vertical axis at a value that shows the level of fixed costs based on its total revenue and total cost curves, a perfectly competitive firm like the raspberry farm one way to determine the most profitable quantity to produce is to see at what quantity total revenue. By comparing marginal revenue and marginal cost, a firm in a competitive market is able to adjust production to the level that achieves its objective, which we assume to be.

Komentar

Posting Komentar